montana sales tax rate on vehicles

Get a quick rate range. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Sales Taxes In The United States Wikiwand

Selling a vehicle in Montana can be done only through a licensed dealer or by the person whose name is on the title.

. For a car purchase with no trade-in your equation would look like this for a. The minimum combined 2022 sales tax rate for Missoula Montana is. Heggen Law Office PCs Montana RV and vehicle registration services are designed for you to avoid sales tax and high licensing fees.

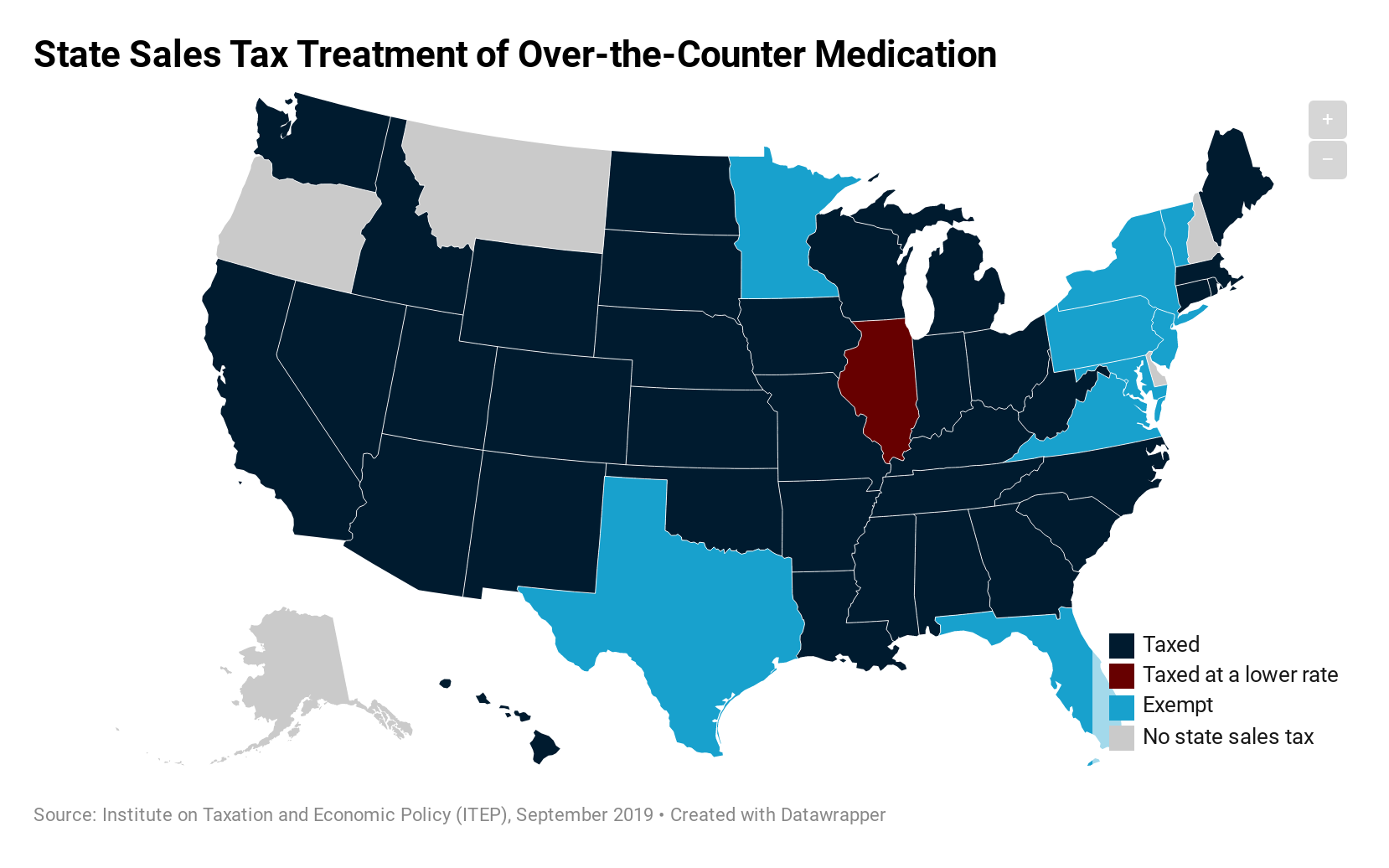

For an accurate tax rate for each jurisdiction add other applicable local rates on top of the base rate. Montana cars and trucks are exempt from sales tax in Montana MCA 61-3-311 and if you own your pickup van or car through a Montana LLC you can take advantage of permanent registration. Registration works a little differently in Montana.

Those between five and 10 years old will pay 87. County tax 9 optional state parks support certain special plate fees and for light trucks the gross vehicle weight GVW fees. Interactive Tax Map Unlimited Use.

Montana does not impose a state-wide sales tax. Add these three tax rates together to find the total sales tax. These taxes include telecommunications tobacco tourism cannabis and health care facilities among others.

You must pay sales tax when you lease a car. Here vehicles four years or younger must pay an annual registration fee of 217. The latest sales tax rates for cities starting with A in Montana MT state.

Just enter the five-digit zip code of the location in which the. Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here as opposed to other states that may have registration fees sales tax and local taxes is significantly lower. Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments.

The Montana sales tax rate is currently. Montana local resort areas and communities are authorized. Consumer Counsel Fee CCT Contractors Gross Receipts Tax CGR Emergency Telephone System Fee.

The County sales tax rate is. Up to 25 cash back The Montana LLC scheme used by the Louisiana taxpayer has been around for years and continues to be promoted by Montana-based lawyers. Vehicles older than 11 years can either pay 28 annually or a one-time 8750 registration fee.

You should contact the vehicles manufacturer directly. The companys analysis shows that the owner of a 23407 vehicle in Montana the average price of all new and used vehicles sold in 2015 will likely spend 27454 to drive maintain insure. If you form a Montana LLC and.

Fees collected at the time of permanent registration are. Local option motor vehicle tax. Imagine that your monthly lease payment is 500 and your states sales tax on a leased car.

However the state does impose a tax on sales of medical marijuana products a sales and use tax on accommodations and campgrounds a lodging facility use tax and a limited sales and use tax on the base rental charge for rental vehicles. If you would like to know if a dealer is legally licensed you can email dojdealerinfomtgov or call the MVDs Vehicle Services Bureau at 406-444-3661 option 3. Wayfair Inc affect Montana.

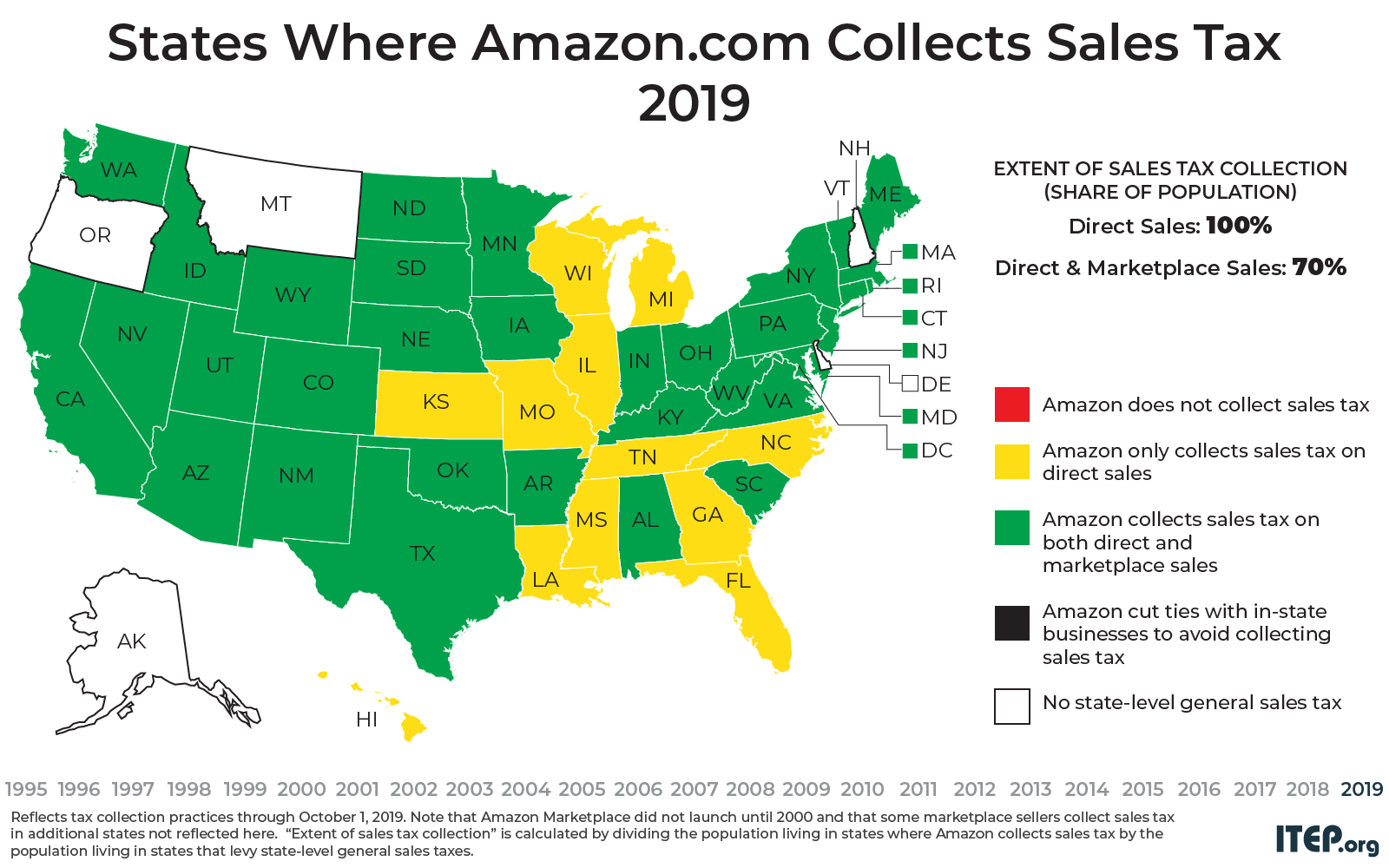

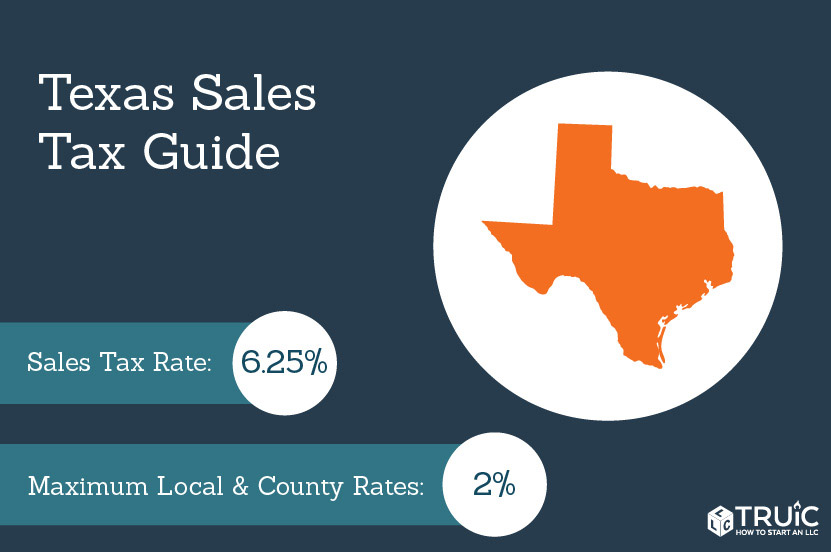

Did South Dakota v. As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state car tax rate of 625 percent with some local rates much higher. 1 A county may impose a local option motor vehicle tax on motor vehicles subject to the registration fee imposed under 61-3-321 2 or 61-3-562 at a rate of up to 07 of the value determined under 61-3-503 or a local flat fee in addition to the fee imposed under 61-3-321 2 or 61-3-562.

Montana has several taxes covering specific businesses services or locations. 2022 Montana Sales Tax Table. 368 rows There are a total of 73 local tax jurisdictions across the state collecting an average.

Base state sales tax rate 0. In most states you pay sales tax on the monthly lease payment not the price of the car. Montana state sales tax rate.

The state sales tax rate in Montana is 0 but you can. The Missoula sales tax rate is. Tax Free Montana Vehicle Registration Services.

It can only work with LLCs formed in Montana because Montana is the only state which imposes no sales tax on the purchase of vehicles by its residents including resident LLCs. Rates include state county and city taxes. With more than 19 years of experience in this field we are ready to answer any questions.

We can form a Montana LLC for you including the LLC formation and initial plate registration all for a total of 849. While the base rate applies statewide its only a starting point for calculating sales tax in Montana. Ad Lookup Sales Tax Rates For Free.

Vehicle owners to register their cars in Montana. Enter zip code of the sale location or the sales tax rate in percent Sales Tax. Determining how much sales tax you need to pay depends on your home states laws and the state in which you bought the car.

If you need assistance gathering contact information call the NHTSAs Office of Vehicle Safety Compliance at 202 366-5291. Buy From a Trustworthy Seller. 2020 rates included for.

What is the sales tax rate in Missoula Montana. This is the total of state county and city sales tax rates. We are known for sound trustworthy advice and smart representation.

10 Montana Highway Patrol Salary and Retention Fee.

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Taxes In The United States Wikiwand

How Do State And Local Sales Taxes Work Tax Policy Center

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Latest Rv Industry Statistics Trends Data 2021 Rv Infographic Off Grid Living

Texas Sales Tax Small Business Guide Truic

How Is Tax Liability Calculated Common Tax Questions Answered

Think Twice About Registering Rv In A Montana Llc Rv Tailgate Life Rv Rv For Sale Rv Life

Montana Sales Tax Rates By City County 2022

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Taxes Are Highest In Tennessee Two Cities In Alabama Aug 19 2010